Banking and loans are two of the most common financial concepts that people will encounter when dealing with money matters. Banks (or credit unions) are often the first financial institution people engage with, and for most Americans, it is the one they engage with most frequently. A 2015 survey by the Federal Deposit Insurance Corporation (FDIC) found that 93% of American households use bank services in some capacity – to pay bills, build savings, or obtain credit. While 93% is a high number, the degree to which people use these financial institutions varies greatly.

The results of a 2015 survey show that, in the Memphis Metro Area, only 54.5% of households are considered “fully banked”. What does this mean? The term "fully banked" refers those who have an account with an insured institution and have not obtained alternative (non-bank) services within the previous 12 months. 21% of households in our area are considered “underbanked”, which means consumers have a checking or savings account with a banking intuition, but they also rely on services from non-bank entities, such as: payday loans, check-cashing services, and pawn shops. Additionally, 17.2% of Memphis-area households are “unbanked”, meaning they do not have checking or savings accounts and do not use banks or credit unions for financial services.

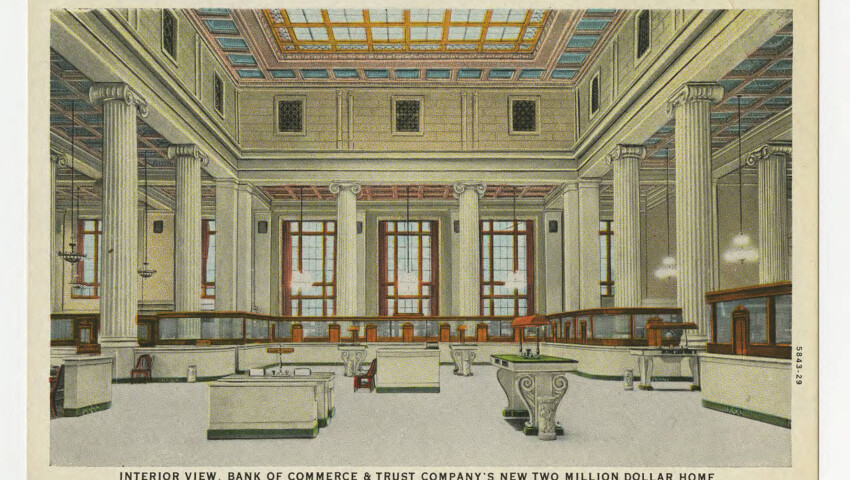

Explore the gallery below for additional information on this topic and to see the history of banking and non-bank institutions in Memphis. You can find all of these images and more in DIG Memphis.